Updates to Amazon’s FBA Return Policy and Fees for 2024

For Amazon sellers, returns and reverse logistics are an important part of your business. Amazon revolutionized online selling with their “try before you buy” and fast, free returns policies, resulting in an average return rate of 5%–15% across categories on the platform. At the same time, that policy yields high extra costs for sellers, some of which are unpredictable.

In addition, returns contribute to significant waste. While Amazon has attempted to offset that waste with a donation program and a secondary market program, experts have suggested for years that the company should add disincentives for returns.

As a result, Amazon’s 2024 return policy and fee updates introduced noteworthy changes like updates to the length of the manual claims eligibility window, new returns processing fees, and automatic reimbursements for items lost in FBA fulfillment centers.

FBA returns processing fees

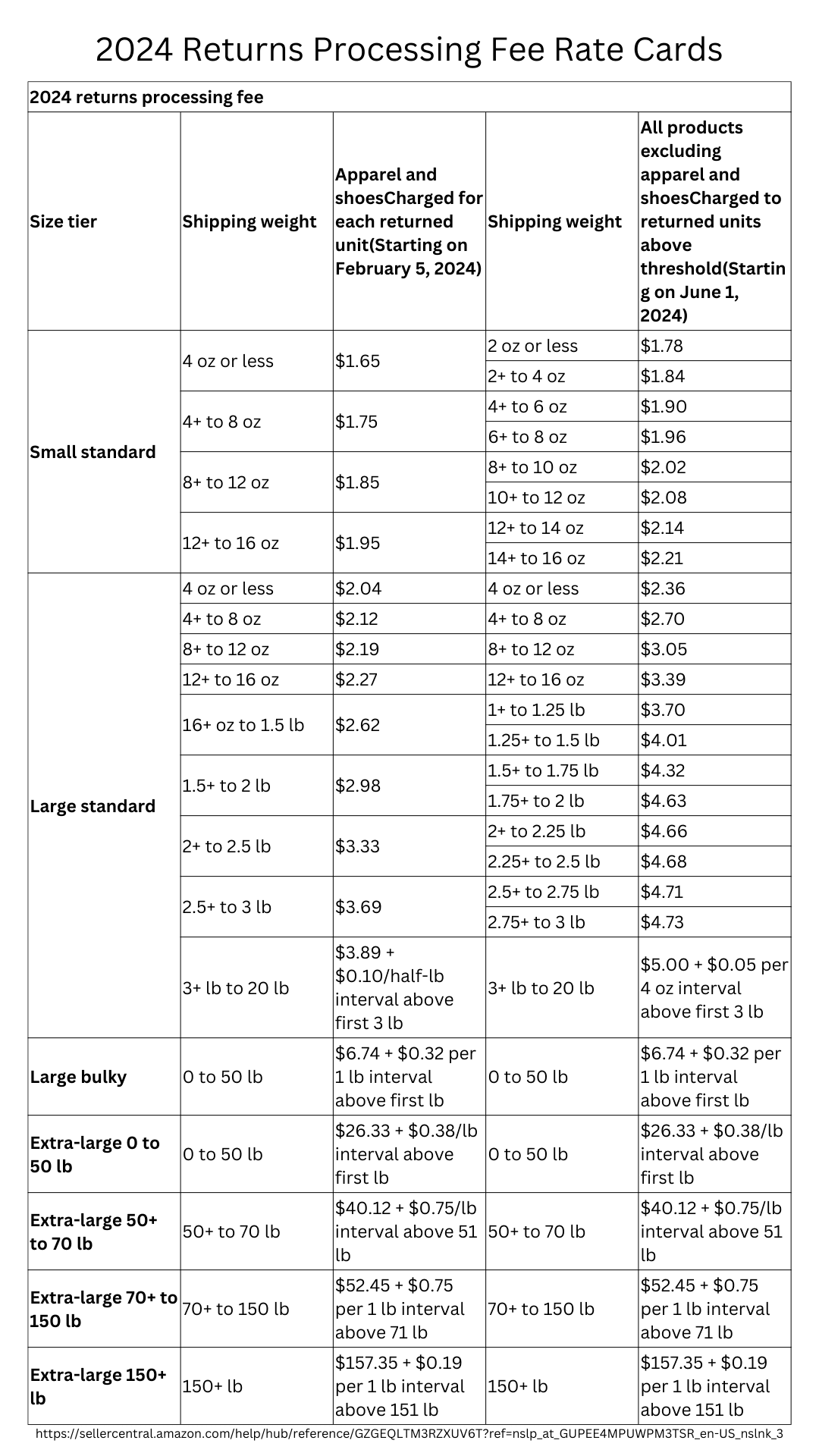

Amazon altered their FBA returns processing fee structure in June of 2024. This includes adjustments to existing fees as well as an additional charge for returns that exceed the normal returns threshold for that category. Other changes are:

- Fees only apply to FBA orders and not to Seller Fulfilled orders.

- Fees will be billed three months following charges incurred.

- Product return rate is visible on the FBA returns page, which is updated three times per week.

- Products that ship fewer than 25 units per month are exempt from additional fees.

- Apparel and shoes are exempt from the threshold limit; instead, you pay for each returned item regardless of the volume of returns.

How are return fees calculated?

Amazon uses product category, product tier size, shipping weight, and return rate plus return rate threshold to calculate the return fee.

- Product size tier: Small standard, large standard, large bulky, etc.

- Shipping weight: Shipping weight registered with Amazon

- Category: Return rate for that category

- Return rate: Return rate for a given item

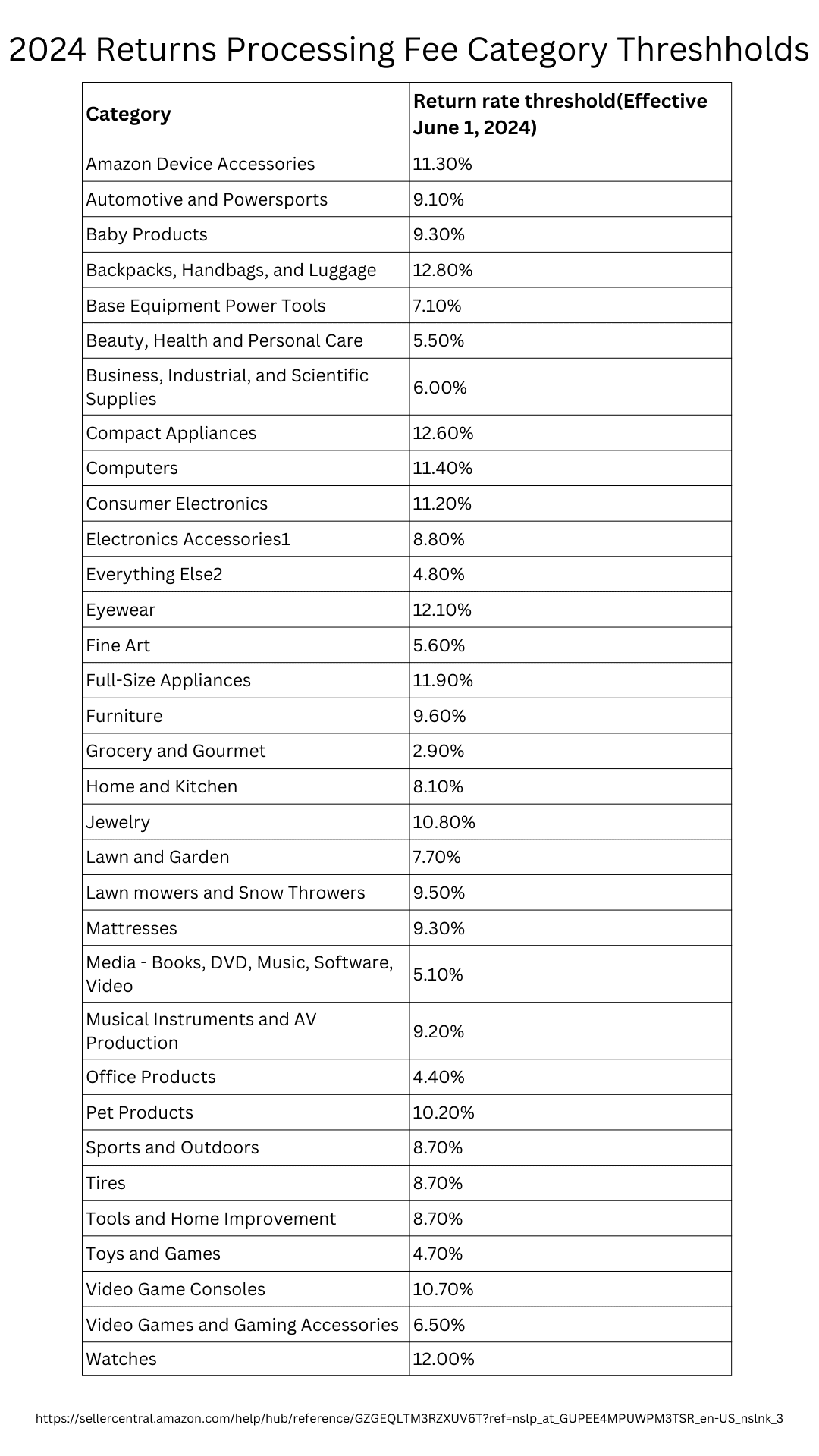

The company published a table of normal expected return rates based on these factors:

Return threshold

The returns threshold refers to the average number of items sent back in a specific category. So, if you sell 1,000 units of Product A and 10 of them are returned, you have a return rate of 10%. If your category has an average return rate of 6% you’d owe the fee on 400 items. On the other hand, if the rate is 12%, you’d be able to have 200 more returns in the given period before incurring the extra fee.

Clothes and shoes are once again exempt from this threshold. However, you do pay a return fee per item.

When you have to pay an FBA returns processing fee

Seller Central forums are full of Amazon sellers concerned about paying fees for returns due to Amazon’s mistakes. However, the company has made it clear they won’t charge for returns that are “Damaged by Amazon” or “Delivered late by Amazon.” In addition, Amazon-related returns do not apply to your return threshold. Fees only apply to items that are physically returned.

Subscribe and Save returns, meanwhile, are subject to the fee, even if the reason for a return is “unwanted item.” You can also expect to pay returns processing for most other reasons. Here’s a rundown of reasons that incur the charge and those that don’t:

- The item and delivery box are both damaged: No fee/Amazon is responsible

- Description on website was inaccurate: Fee applies over the return threshold

- Inadequate performance or quality: Fee applies over the return threshold

- Item is defective or does not work: Fee applies over the return threshold

- Arrived in addition to what was ordered: Fee applies over the return threshold

- Unauthorized purchase: Fee applies over the return threshold

- Accidental order: Fee applies over the return threshold

- Missing parts or accessories: Fee applies over the return threshold

- No longer needed: Fee applies over the return threshold

- Found better price somewhere else: Fee applies over the return threshold

- No reason given: Fee applies over the return threshold

- Incompatible or not useful for intended purpose: Fee applies over the return threshold

- The item is damaged, but the box or envelope is undamaged: No fee/Amazon is responsible OR the seller is charged depending on the cause of the issue. As with general damaged or faulty product returns, Amazon will evaluate the returned item to determine who’s at fault. Seller and customer faults both result in a returns processing fee for the seller.

- Wrong item was sent: No fee/Amazon is responsible

- Missed estimated delivery date: No fee/Amazon is responsible

Amazon’s updated FBA Returns page offers insights into returns, return thresholds, and reasons for items sent back. This makes it easier to see what your return rate is, what’s normal for the product category, and if you have problematic ASINs. For example, if most of your returns stem from a single product, you should investigate the reasons why and take steps to reduce the number of them.

Learn more about how to reduce returns on Amazon through our article here.

Amazon is taking no further steps to prevent customers from abusing returns. However, in the case of excessive returns, the company may warn the buyer and limit their return privileges. This means if a customer is flagged as potentially abusing the system, Amazon will restrict their ability to send back orders. However, the seller is still responsible for returns processing fees up to that point.

Changes to claims and reimbursements

Amazon doesn’t charge a returns processing fee for items when they are at fault. They’re also taking steps to improve claims so that when items are returned because of the company’s fault or when products are damaged in FBA, sellers will automatically receive reimbursement.

Starting November 1, 2024, Amazon proactively reimburses sellers for items lost in their fulfillment centers. The company’s goal is to ensure sellers automatically receive reimbursement without the need to research lost items and file claims manually. However, if you believe your product has been lost and you haven’t received an automatic reimbursement, you can file a manual claim as before. This must be done no later than 60 days after the item was reported lost or damaged though.

In addition, from October 23, 2024:

- A removal claim for items lost in transit can be submitted 15-75 days after the shipment creation date.

- Removal claims must be submitted within 60 days of an item being shipped back to you.

- Customer returns claims must be submitted 60-120 days after the customer refund or replacement date. This is to ensure buyers have time to return items first.

These changes essentially mean: a) Amazon will attempt to reimburse sellers proactively for items lost in transit or in FBA warehouses; b) you have to pay attention to the timeline following lost or damaged item reports before filing claims; c) customer returns for lost or damaged items now wait 60 days before reimbursement can occur and should be filed no later than 120 days after the return claim.

Wrapping up — Stay on top of Amazon’s changing returns policy

With an average return rate of 5%–15% across most Amazon categories, the number of goods returned on the platform is astronomically high. As of 2024, Amazon charges a returns processing fee for FBA returns that exceed normal return thresholds. This means if your product is returned more often than other items in its category, you’ll pay for it. Clothing and shoes are exempt from this charge, and you’ll instead pay a standard per-item returns processing fee. You can track returns and the reasons for them on the FBA Returns page for better insights into what’s going wrong and when. Armed with this knowledge, you can take steps to lower your average return rate and prevent unnecessary fees from eating into your profits.